- Inflation Reduction Act's 45W, intended for commercial fleets, subsidizes EV leasing

- Up to $7,500 of federal money applies to EV leases regardless of their price or where they're built

- That's stoked a leasing boom that undercuts some of the original intent of the IRA

If you seek a new luxury EV, or an EV made overseas, the payment math may point toward some very attractive lease terms—even when compared versus sensibly financed purchase terms.

Why? Thank the government—and the U.S. Treasury Department, which opted to interpret and implement subsidies from the Inflation Reduction Act in a way that some lawmakers argue doesn’t keep to the original intent of the law.

The funds sweetening consumer leases come from the Commercial Clean Vehicle Credit, or IRS 45W, which was enabled by the IRA. Originally intended to allow operators of commercial fleets a subsidy for adopting EVs, its final language was tweaked to allow automakers’ captive finance partners to apply the credit to EVs leased to consumers.

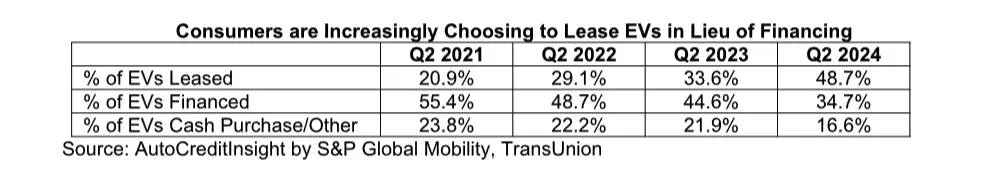

Nearly every EV can qualify for such a credit toward leasing, while credits on EV purchase only apply to a small subset of EVs. So it’s not surprising that as a result, leasing is surging relative to sales—and it’s the EV segment that’s pulling more weight in this surge than non-EVs.

TransUnion EV lease rates by year

Federal funds partly behind an EV leasing surge

In a report from the credit giant TransUnion out earlier this month, EV leasing has helped push overall lease volumes from 539,000 in Q1 2023 to 714,000 in Q3 2024. That’s approaching the leasing levels seen in 2020, when interest rates were much lower.

According to Satyan Merchant, senior vice president for auto and mortgage at TransUnion, the number of lower-priced EVs arriving on the market had a role, as well as the arrival of leasing incentives—in the form of federal tax credits resulting in subsidized EV leases that applied starting in January 2023.

What IRS 45W has meant in the context of passenger vehicles is that, indirectly, automakers have been able to count on up to $7,500 per EV they lease—regardless of the vehicle’s assembly location, the origin of its battery pack or materials, or the sticker price of the vehicle, and regardless of the lessee’s household income. There’s also no limit to the number of credits an automaker—nee leasing company—can claim toward leasing, or to the number of federally subsidized EV leases a customer can commit to.

That’s made leasing a more preferred mode of moving luxury and imported EVs—because IRS 30D, the Clean Vehicle Credit that applies to the purchase of EVs or plug-in hybrids, emphasizes affordable American-made EVs built with the support of battery materials from North America or trade partners. To claim that EV tax credit of up to $7,500, buyers must meet household-income requirements and the vehicles meet a set of criteria for American assembly, EV battery sourcing, and a price ceiling of $55,000 or $80,000 depending on the vehicle type.

2024 Ford Mustang Mach-E GT

For EVs, leasing surpasses financing

“Auto leasing has certainly been up overall in recent quarters, but nowhere has it been more pronounced than in the EV market, where leasing has now surpassed financing as the preferred option among consumers acquiring a new EV,” said Merchant.

The TransUnion observation is the latest piece of broad leasing-industry data to see that the dynamics around leasing are changing, with EVs front and center. Last year, fellow credit giant Experian noted a market shift toward EV leasing, with the shift easy to see starting around April 2023—just as those a few months.

That in itself leads to a paradox of sorts. The boom in leasing, spurred by the Inflation Reduction Act itself, arguably softens the intended incentives for industry to build out the EV supply chain and build more EVs in America—just before that IRA buildout really starts to pay off in more American-made and American-sourced EVs.

UAW-made sticker on 2022 Chevy Bolt EV

Biden EV policy working against itself?

“If consumers choose to take up the tax credit primarily via leasing under Section 45W, automakers will not face financial pressure to use battery components sourced from the United States, use recycled batteries, or source critical minerals from the United States or free trade agreement partners,” summed the Peterson Institute for International Economics in a May 2023 working paper on the IRA, pointing out that U.S. imports of EVs from the EU and South Korea have increased since the IRA. “Section 45W thus reduces the incentive to create a separate redundant EV battery input supply chain outside of China.”

The policy has, however, led to greater lease popularity for U.S.-made, affordable EVs, too. Last year Experian noted that the Tesla Model 3 is one of the top-ten most-leased models in the U.S.

Tesla Model 3 (Europe-market refresh)

Last year, Green Car Reports reached out to the majority of automaker finance firms and the IRS regarding the frequency of 45W claims in EV lease financing, and those captive finance companies that responded stated that they were choosing to keep that information private. We recently reached out again to the IRS and to the Treasury Department for an update for more of a face-value impression of how much finance companies and automakers are depending on these funds.

The IRS didn't comment but suggested the source of such data would be the Treasury Department. Treasury confirmed to Green Car Reports Friday that it doesn't yet have top-level data for 2023 regarding the amount claimed under 45W, how many vehicles it applies to, or the end use of vehicles for which the claims are made.

In the meantime, the consumer EV leasing market will likely continue to be subsidized with federal funds until Congress steps in and sets some ground rules. That means subsidized EV leases will continue until next year’s session at the earliest. As with so much about current EV policy and election season, it’s all subject to change.