General Motors is reportedly working to develop a fully electric van that might be aimed at a potential profit center for vehicle makers: commercial delivery fleets.

The model, according to Reuters, is code-named BV1 and due to start production in late 2021—placing it within a half-year of the arrival of the GMC Hummer pickup and SUV and the Cadillac Lyriq electric SUV. Reuters expects the model to be built at the same Detroit-Hamtramck plant.

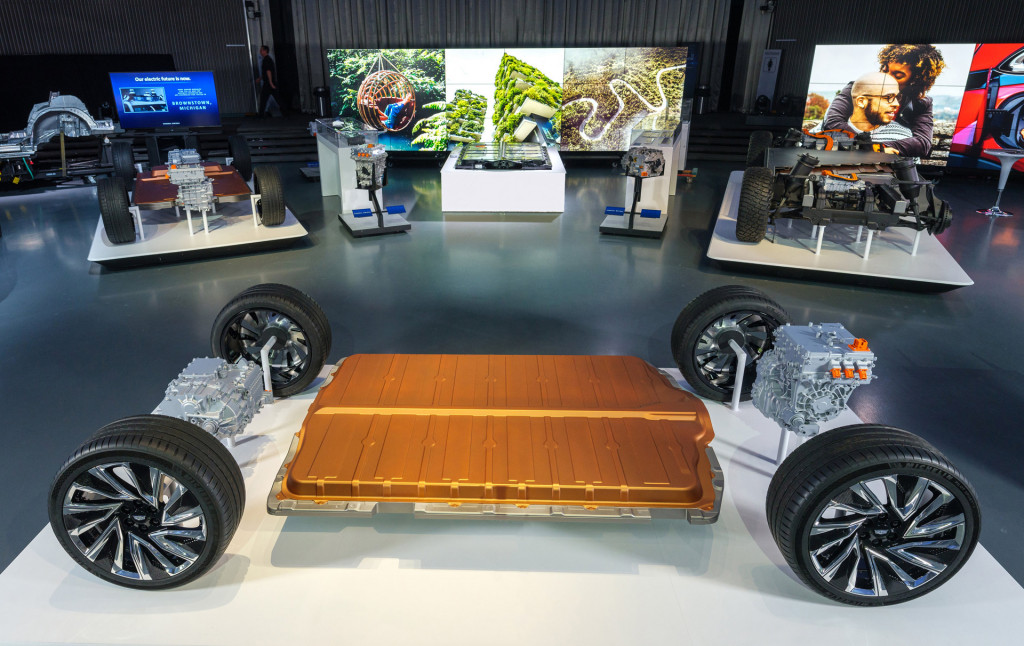

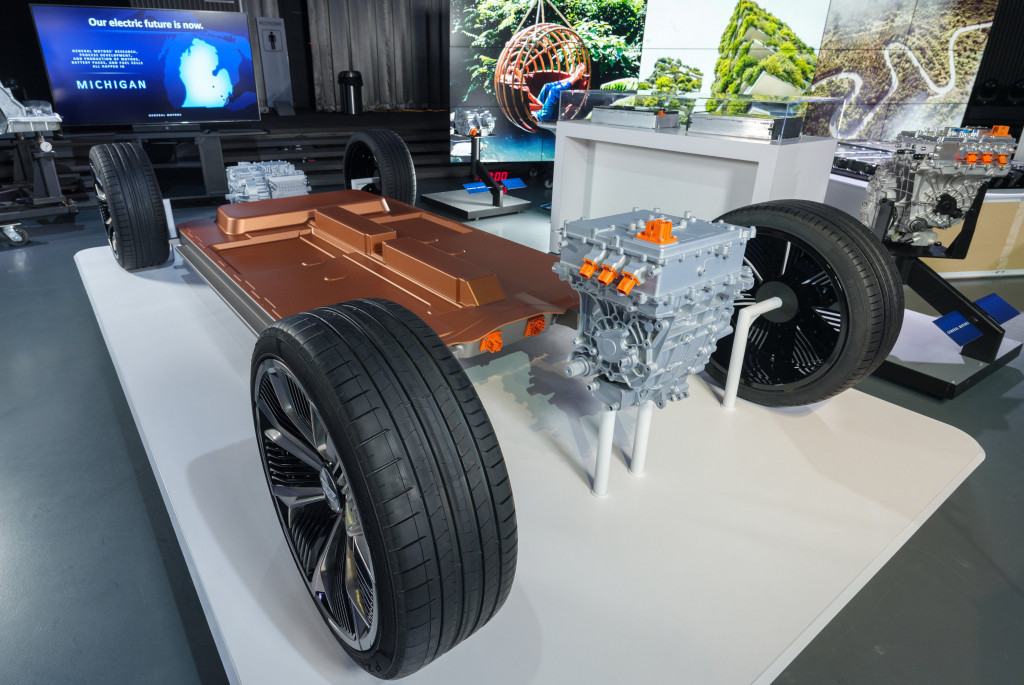

GM has previously said that it will introduce 20 new all-electric models by 2023, with a wide range of body styles possible under the company’s upcoming BEV3 architecture and Ultium battery-and-propulsion toolkit.

General Motors' BEV3 platform and Ultium batteries

The van might be a missing piece of sorts; when the Cruise Origin driverless vehicle was introduced officials wouldn't rule out the possibility of other vehicles coming with that form factor. The Origin is also to be made at that same plant.

Scott Phillippi, the director of fleet maintenance at UPS, told Reuters that electric vans still have the potential to disrupt the commercial-vehicle market.

Several startups have attempted to carve out a niche in the electric-van realm—specifically for “last-mile” delivery—but those efforts so far have been from smaller firms like Chanje and Workhorse. So far there’s been no Model 3 moment for that sector.

Rivian electric delivery van for Amazon

The closest it’s come is when Amazon in 2019 made its largest order ever for electric vehicles—to Michigan’s Rivian, which will deliver 100,000 fully electric vans for Amazon delivery use, starting with 10,000 of them to be in service as soon as 2022.

Ford said earlier this year that it would be introducing an all-electric version of its Transit van to the U.S. in 2022, after a European-market introduction in 2021. So far, Mercedes-Benz and parent company Daimler have voiced no plans to bring the Mercedes eSprinter or its upcoming longer-range EQV electric vans to the U.S.

With the right positioning, companies have been anticipating such a move to all-electric vehicles for several years—especially for last-mile delivery. The fleet business is driven strictly by cost of ownership and how the vehicles can be amortized over the long term.

General Motors' BEV3 platform and Ultium batteries

For larger companies, EVs’ lower maintenance and the second-use potential with longer-lasting batteries are altogether very attractive. That’s in addition to companies simply having the stable, predictable fuel expense of energy from the grid and renewables, versus the volatility of gas and diesel.

GM has stated that it’s positioned its upcoming EVs at the more upscale end of the market so that they might be profitable. If it can carve out enough manufacturing cost for a cost-conscious electric delivery mule, preempting others could be a smart move.